Expertise

Our team has extensive experience in insurance premium funding and can provide clients with personalized, expert advice on the best options for their needs.

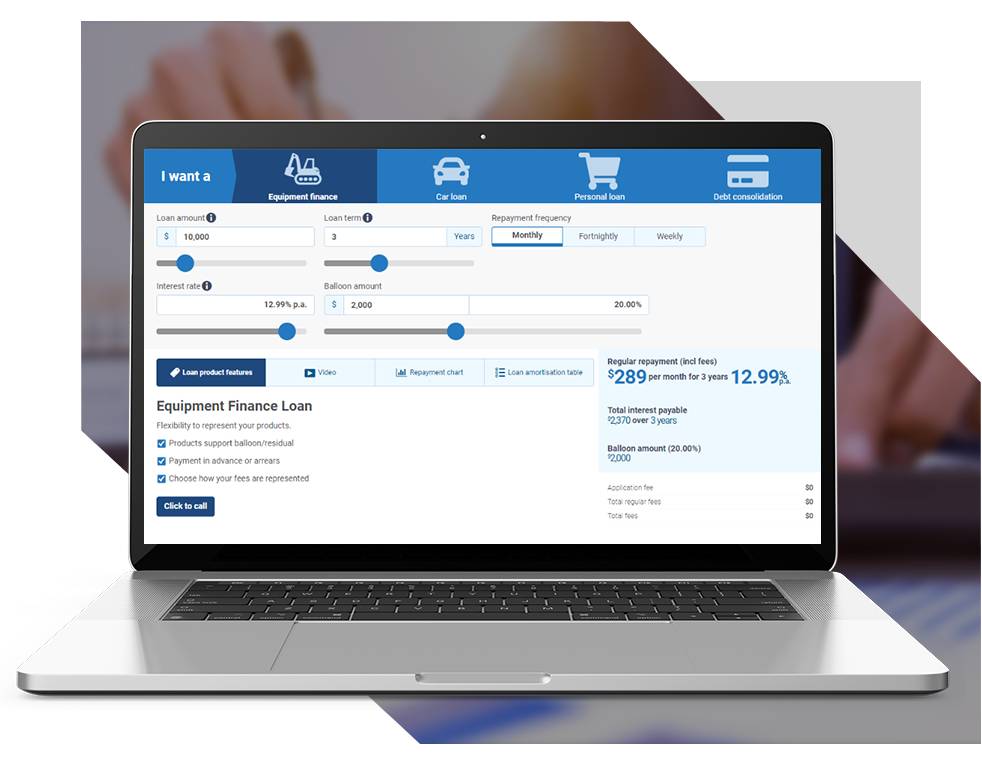

Flexible Repayment Options

We offer a range of flexible repayment options to suit the unique circumstances of each client, including the ability to make lump sum payments or extra repayments at any time.

Competitive Interest Rates

We work with a variety of lenders to secure competitive interest rates for our clients, ensuring that they receive the best value for their money.

Convenience

Our remote application process is quick, easy and secure, and our team is available to assist clients with any questions or concerns they may have throughout the process.