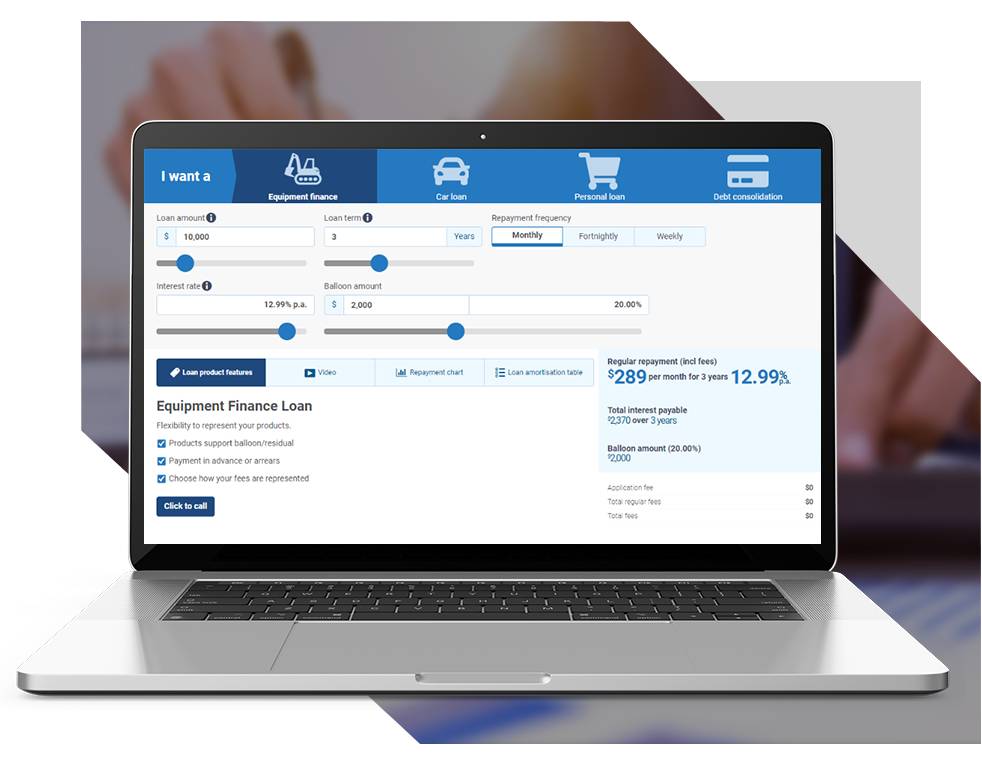

Fast

Accelerate your business growth with fast and efficient business acquisition finance applications. Quick approvals, flexible terms, and tailored solutions for your unique needs.

Opportunity

Business acquisition finance opens doors to new growth prospects by offering flexible funding solutions and the ability to acquire new assets and companies.

Pre-approvals

Streamlined pre-approval process for business acquisition finance offers quick access to funding, allowing for smooth and efficient business expansion.

Expertise

Centrepoint Finance offers expert guidance and tailored solutions in business acquisition finance, providing efficient and effective financing options for your business growth.