Competitive

Centrepoint Finance’s competitive international trade finance service provides businesses with the potential to grow their global trade operations by offering flexible and cost-effective financing solutions.

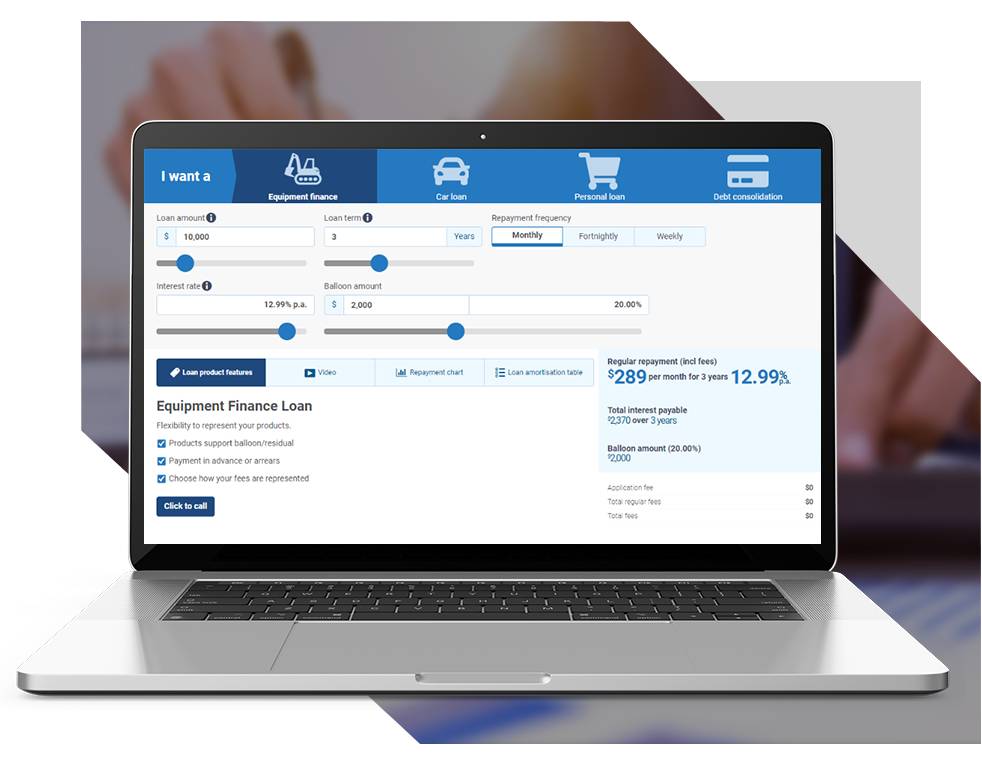

Easy

Centrepoint Finance offers an easy process for businesses to access their international trade finance services, allowing for a streamlined and hassle-free experience for companies looking to expand their global trade operations.

Expert Team

With an expert team of specialists, Centrepoint Finance provides comprehensive international trade finance services, enabling companies to fully realize their potential for growth in the global marketplace.

Tailored

Centrepoint Finance offers tailored solutions for international trade finance, empowering businesses to meet their unique needs and reach their full potential anywhere in the world.