Get Pre-Qualified

At Centrepoint Finance, getting pre-qualified for working capital finance is a simple and straightforward process. Our team of experts will assess your financial situation and provide you with an estimate of the loan amount you may be eligible for.

Easy

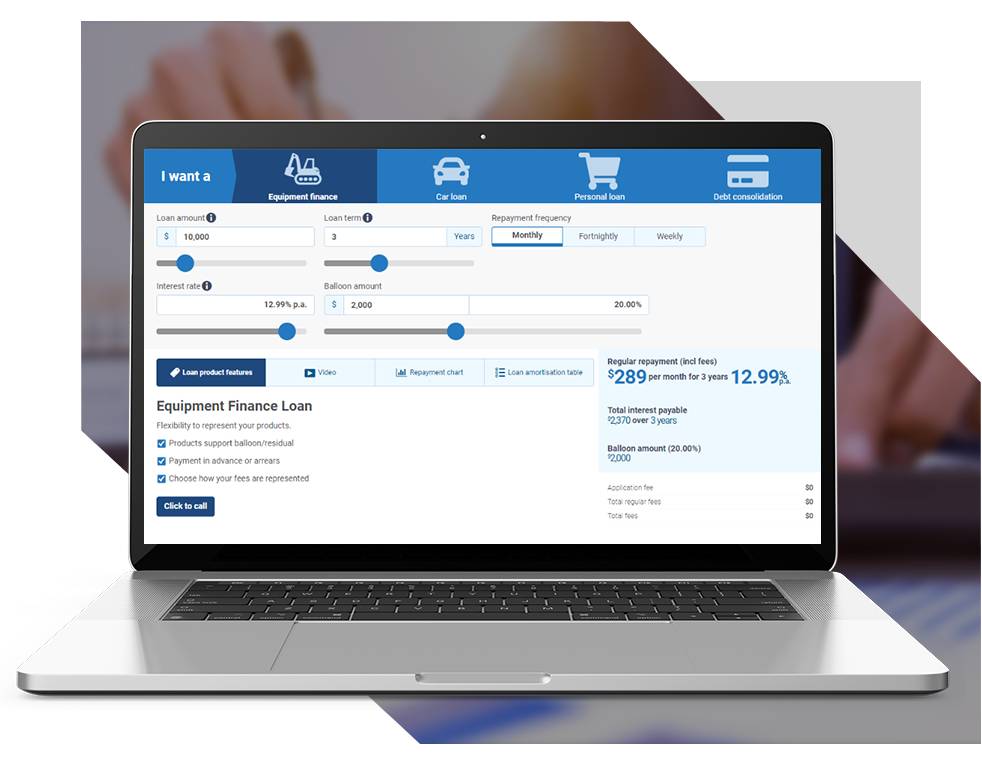

Our team of experts guides you through the entire process, from pre-qualification to final approval. Our easy application process saves you time and stress, allowing you to focus on growing your business.

Fast Approvals

Centrepoint Finance offers fast and efficient approval process for working capital finance applications. Our experienced team and automated systems ensure quick turnaround times for our clients.

Tailored

Centrepoint Finance provides tailored solutions for working capital finance, customised to meet the unique needs and goals of each business. Our Capital Finance specialists work with clients to create customized packages for optimized financial success.